In Short:

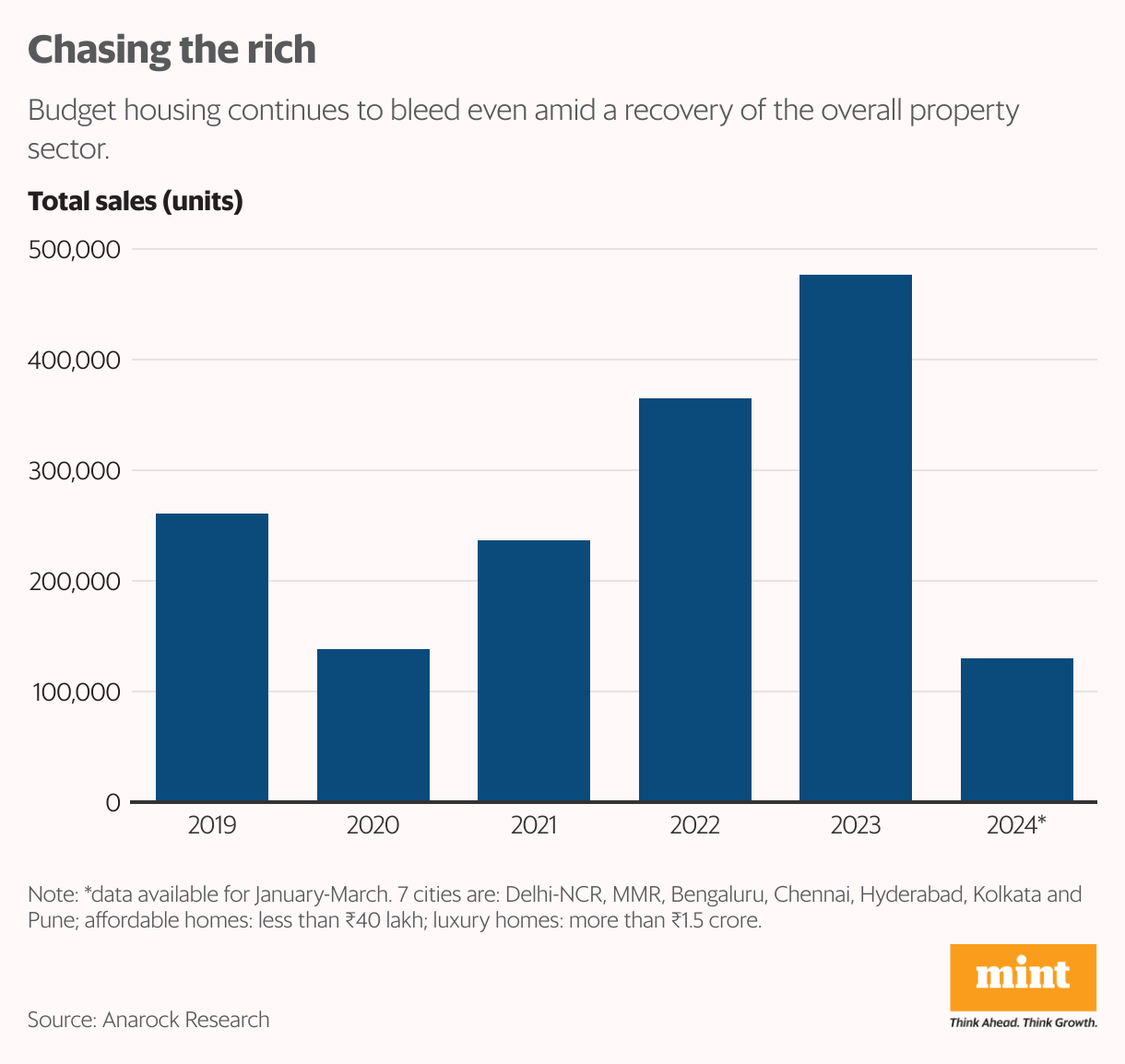

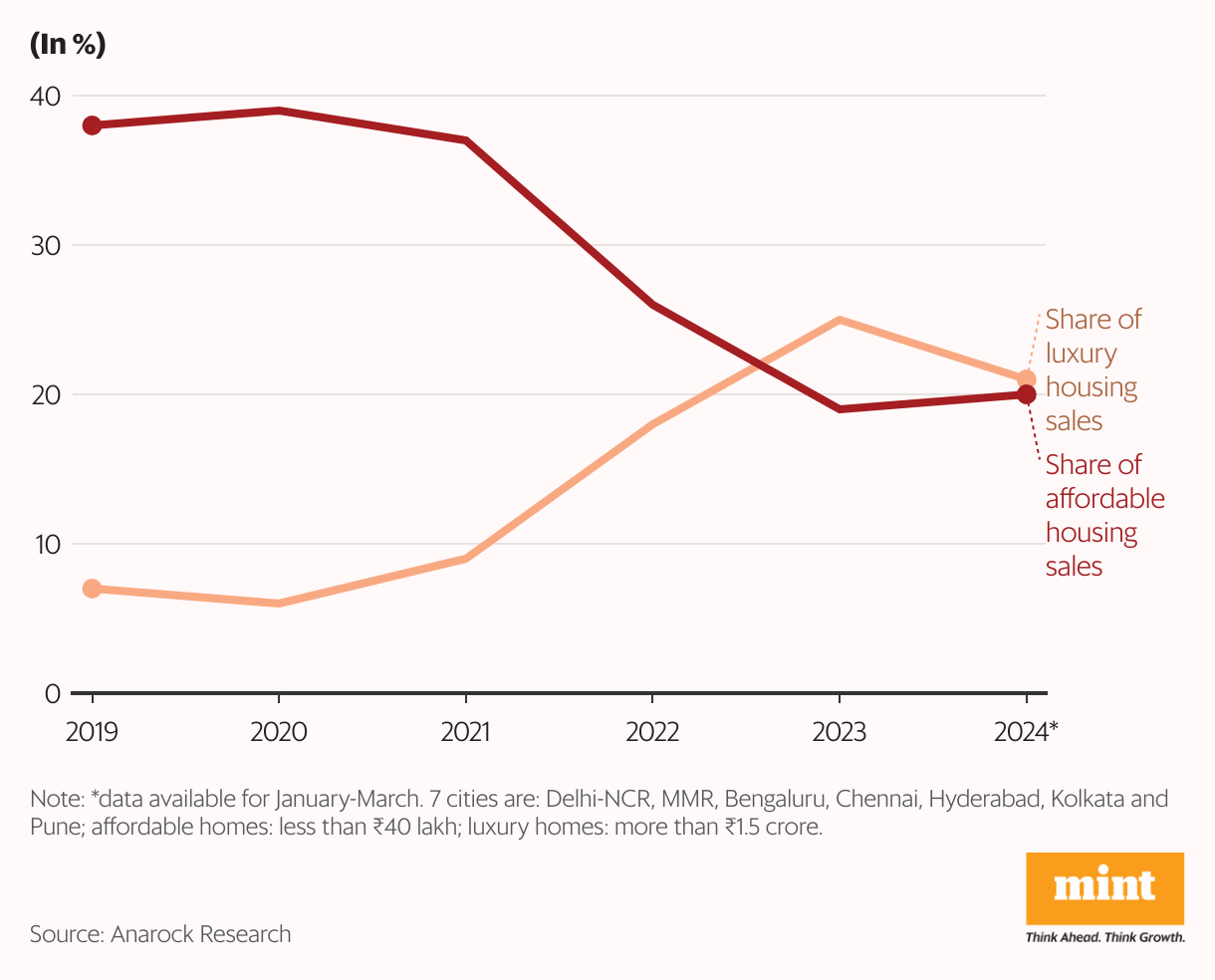

The housing boom has led to a decline in affordable homes sales while luxury homes have thrived. Affordable housing sales dropped to 19% in top cities, while luxury housing sales increased to 25% by 2023. Kolkata is an exception with steady sales of budget homes. Government intervention is needed to revive budget housing, with proposals for new incentives and subsidy schemes for low and middle-income individuals.

The Housing Conundrum: Affordable vs Luxury Homes

In the midst of the ongoing housing boom, a surprising casualty has emerged – affordable homes. While the overall property sector has witnessed a recovery, sales and supply of budget housing have been steadily shrinking. On the flip side, luxury homes are on the rise. The question now is, can the dream of owning a budget home be revived? Let’s delve into the details.

How did affordable housing lose its sheen?

Sales of homes priced at ₹40 lakh and below have been on a downward trend in major cities over the past five years. Despite an overall uptick in the property market, affordable housing has seen a decline. The share of affordable housing sales dropped from 38% to 19% between 2019 and 2023, while new launches also decreased significantly. This decline became more pronounced post-pandemic, as larger, premium homes became more appealing to buyers.

How has luxury housing fared?

On the other hand, luxury housing has seen an increase in both supply and sales, especially in premium locations with higher price points. The share of luxury home sales rose from 7% in 2019 to 25% in 2023, with Mumbai Metropolitan Region leading the pack. The trend is expected to continue, with investors showing renewed interest in this segment.

Is this the norm across major cities?

Kolkata has been an exception, with steady demand for budget homes due to moderate price increases. In contrast, NCR has seen a shift from affordable housing dominance to a decline in the sales share.

How can budget housing recover?

Reviving budget housing will require government intervention and incentives for developers. The discontinuation of the credit-linked subsidy scheme (CLSS) in 2023 has posed challenges, but a similar scheme could provide much-needed relief to borrowers. Subsidized land for affordable housing could also be a viable solution.

Has the government proposed anything?

The government has hinted at a new housing scheme for the urban middle-class and a home loan interest subsidy scheme for low and middle-income groups, aimed at providing relief in interest rates and loans for building homes.