In Short:

AU Small Finance Bank has applied for a universal banking license, which would make it the first small finance bank (SFB) to become a full-fledged bank. Capital SFB also plans to shift within 12-18 months. While SFBs have grown their deposit base, they face challenges like rising NPAs and profitability issues. Universal banking will help them diversify loans and reduce costs.

AU Small Finance Bank Eyes Universal Banking License

Earlier this month, **AU Small Finance Bank**, recognized as the largest small finance bank (SFB) in India by market capitalization and advances, announced its bold move to apply for a universal banking license. If granted, this license would mark a significant milestone, making **AU** the first SFB to fully transition into a mainstream bank. But it’s not just **AU** with aspirations; their smaller competitor, **Capital SFB**, is also looking to make this leap within the next 12 to 18 months.

Understanding the New Criteria

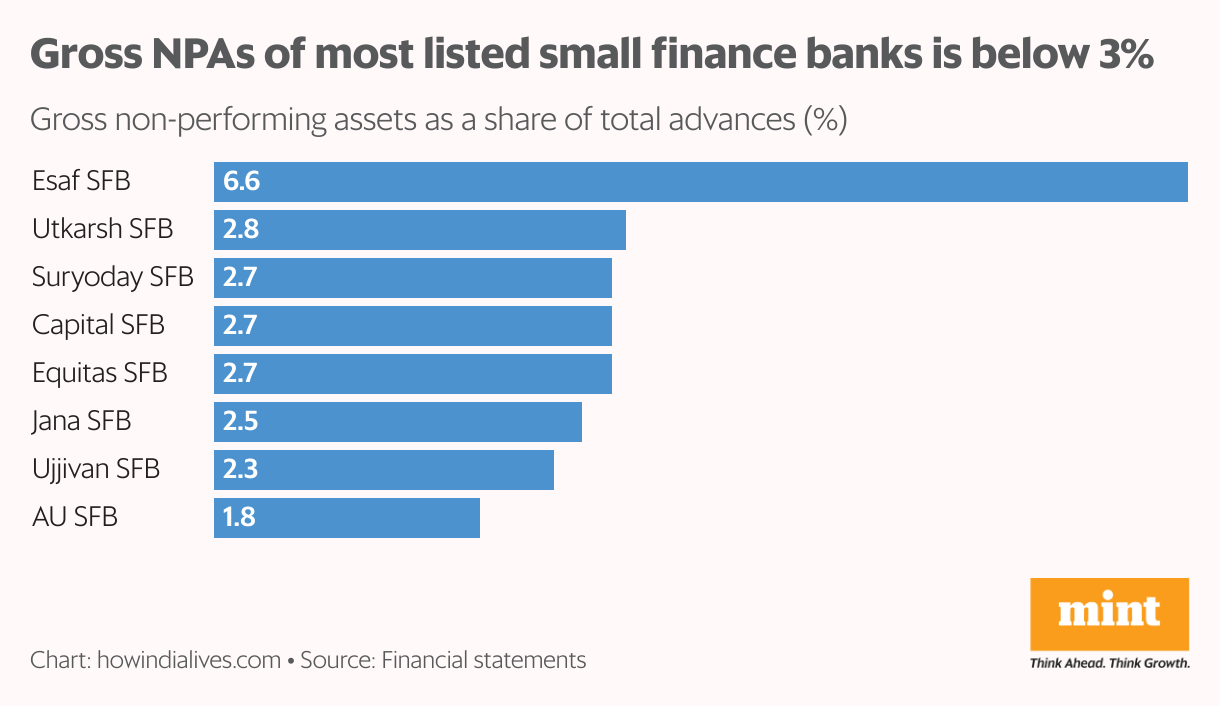

The **Reserve Bank of India** (RBI) revised its criteria back in April, now requiring a net worth of ₹1,000 crore, gross non-performing assets (NPAs) below 3%, and net NPAs under 1% for two consecutive years, among several other conditions. As of March 2024, **AU** proudly stands out as the only SFB meeting all these vital benchmarks.

Spotlight on SFB Performance

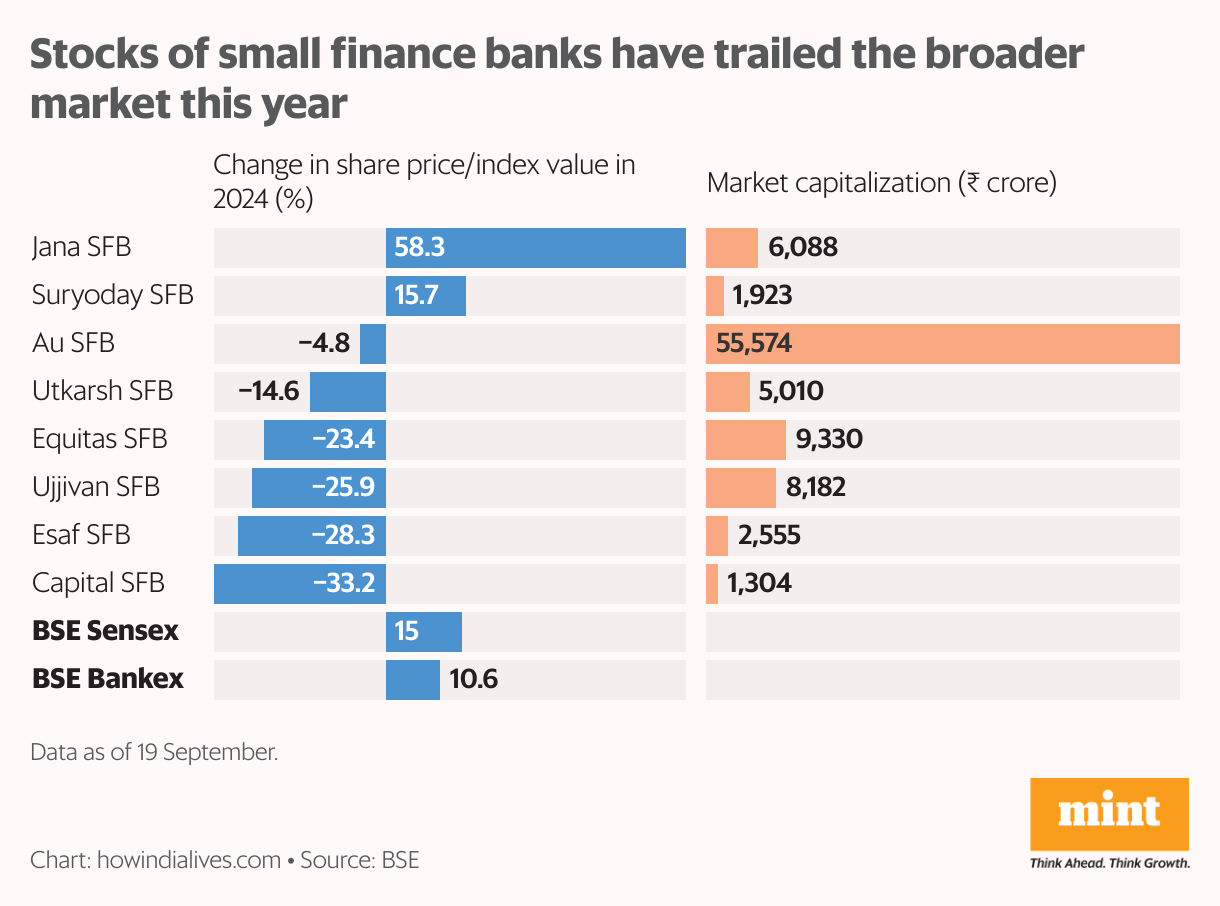

While several SFBs dream of becoming universal banks, they have faced challenges this year. Out of the 11 SFBs, eight are publicly listed, and six are lagging behind the broader **BSE Sensex** and the **BSE Bankex**, which specifically tracks the banking sector.

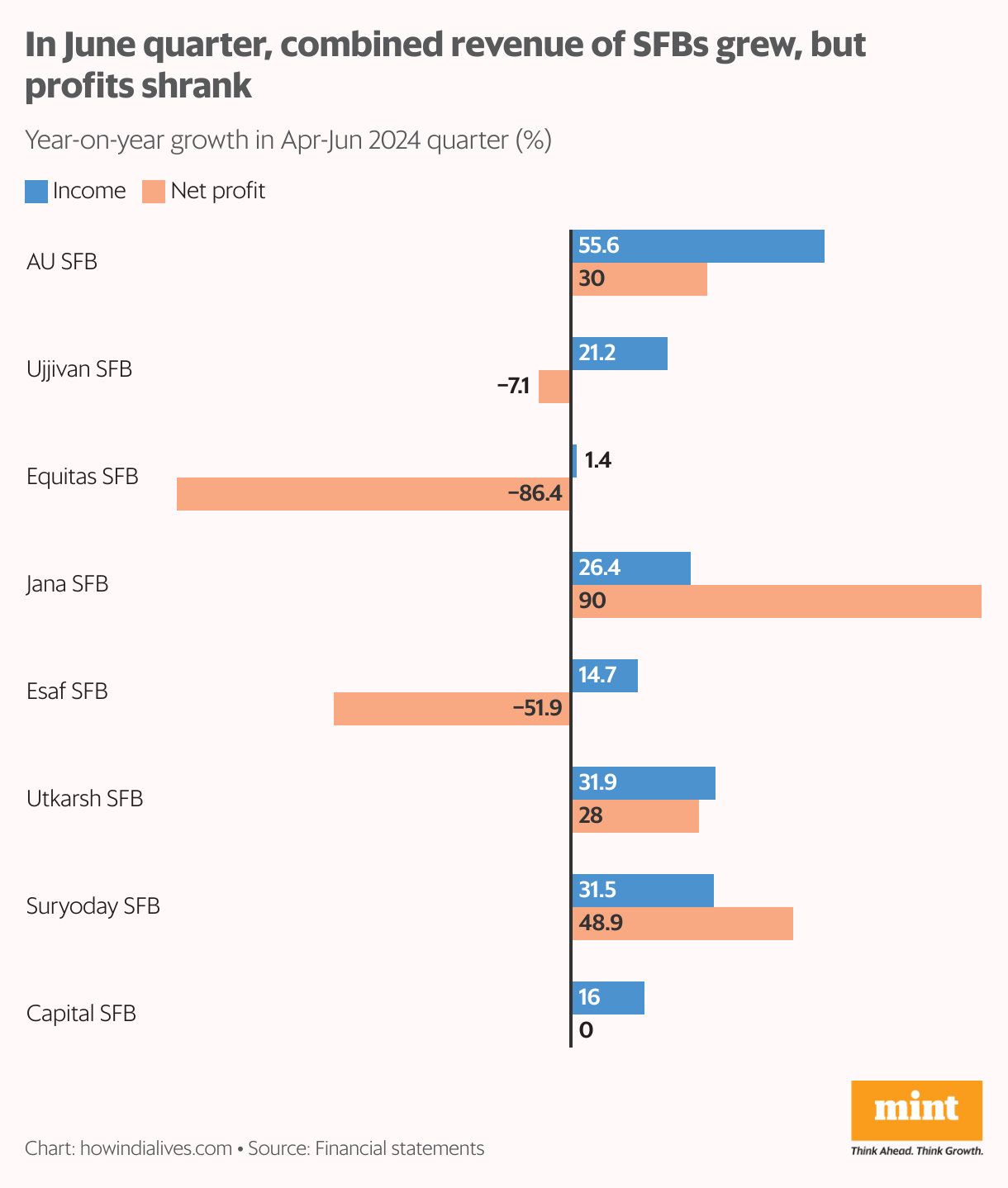

A major factor in this underperformance seems to be the strain on profits. During the quarter ending in June, while total income surged by 29% for these eight SFBs, profits took a hit. The downturn was notably influenced by **Equitas SFB**, which set aside ₹180 crore as a safety net against bad loans.

Striving for CASA Growth

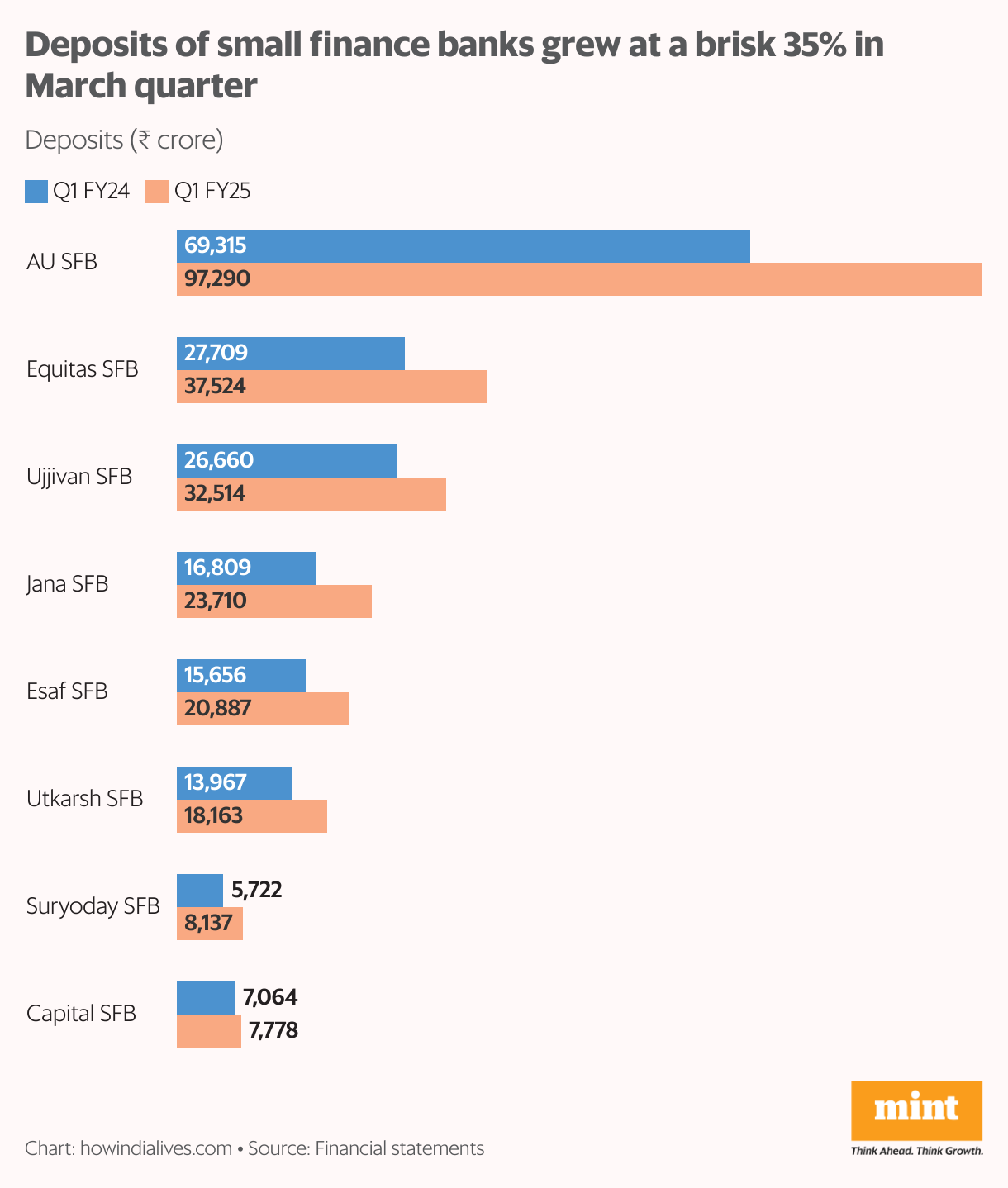

Despite some apprehension that the ‘small finance’ label might raise eyebrows among depositors, SFBs have impressively grown their deposit base. In the June quarter, total deposits of the eight listed SFBs increased by a remarkable 35% year-on-year. According to a report by **CareEdge** from January 2024, the credit-deposit ratio of SFBs is still higher than that of the broader banking sector, although this ratio has been steadily decreasing over the years.

However, the report also sparked concerns regarding SFBs’ ability to attract low-cost deposits, especially current account and savings account (CASA) funds. Recently, banks have been prompted by both the government and **RBI** to bolster their deposit growth. In reaction, SFBs have upped their deposit rates this month, but this could squeeze margins if lending rates don’t rise in tandem.

Beyond Microfinance: A Challenge for SFBs

Once hit hard by the pandemic, where gross NPAs soared to 5.34% in 2021 and 7.32% in 2022, SFBs have shown resilience. As of June 2024, seven out of the eight listed SFBs reported gross NPAs of under 3%. Yet, these institutions continue to grapple with lending limitations, both inherently and through regulatory guidelines. Many SFBs began as microfinance institutions, thriving in that space, but diversification remains a challenge.

The need for diversification is urgent. Initially, SFBs were established to enhance financial inclusion, which comes with stringent requirements for priority sector lending (PSL) and caps on loan sizes. A suggestion by **Icra** indicates that easing the 50% exposure rule up to ₹25 lakh and lowering PSL criteria could encourage more diverse products. Notably, the share of microfinance within SFBs has dwindled from 40% of advances in 2019-20 to 32% in 2022-23, while secured loans, including home loans, are on the rise. Obtaining universal banking licenses could pave the way for further diversification.

Cost Challenges Ahead

Though SFBs have a unique edge, they face distinct cost challenges rooted in their microfinance backgrounds. Many started with substantial staffing but lack the robust infrastructure that traditional banks enjoy today. As of July 2024, all SFBs collectively managed approximately 3,200 ATMs—just a speck compared to the whopping 216,000 ATMs scattered across India. While they’ve issued 34 million debit cards usable at any ATM, owning ATMs enhances brand visibility, a crucial factor in attracting CASA deposits.

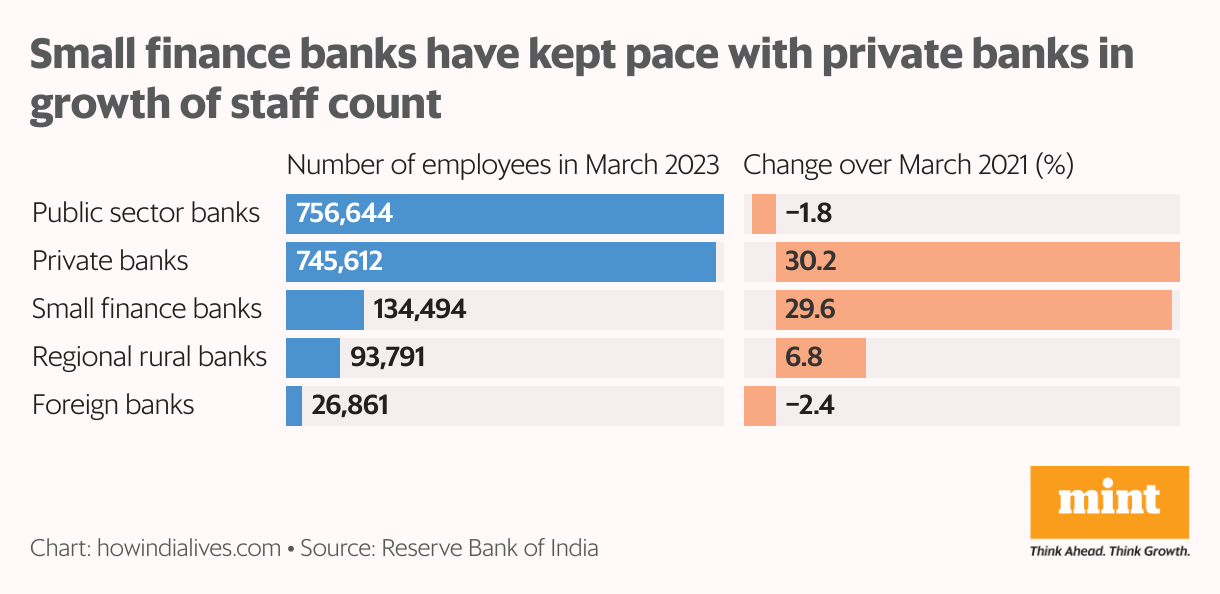

Enhancing their loan portfolios while keeping NPAs in check necessitates investments not only in technology but also in human resources. As of March 2023, SFBs employed around 135,000 staff members, reflecting a 30% increase over two years, indicating competition with private sector banks to attract talent. With the strategic freedom that comes with being a full-fledged bank, it’s clear why some SFBs are eager to step into the universal banking realm.

www.howindialives.com is a comprehensive database and search engine for public data.