In Short:

Banking experts believe that the proposed rule by RBI may discourage lenders from financing projects, leading to higher lending rates. RBI has imposed several stringent measures lately to strengthen norms. It has not hesitated to take action against big financial entities like Kotak Mahindra Bank. The regulator has tightened its grip on NBFCs and fintechs, aiming for better governance standards. The industry may benefit from an appellate tribunal to challenge RBI’s decisions.

RBI Imposes Stricter Regulations on Banks and NBFCs

Private Investment Concerns

Banking experts believe that the proposed rule by the RBI will discourage lenders from financing projects, jeopardizing private investment during a crucial time for India’s private capex cycle.

Focus on Governance

The RBI has been implementing stringent measures to tighten norms, eliminate loopholes, and ensure compliance by the entities it oversees. It has not hesitated to take action against big corporate-backed financial services entities, including Kotak Mahindra Bank.

Regulatory Clampdown

Several banks and non-banking financial companies (NBFC) have faced regulatory actions in recent times, including JM Financial, Bajaj Finance, IIFL Finance, and Paytm Payments Bank. The RBI is determined to promote a culture of compliance across all financial entities.

Cracking Down on FinTechs

The RBI has been reigning in on fintech companies involved in lending activities to protect consumers and prevent loan scams. It has issued guidelines to regulate digital lending in India and has tightened control over payment intermediaries.

Emphasis on Governance Standards

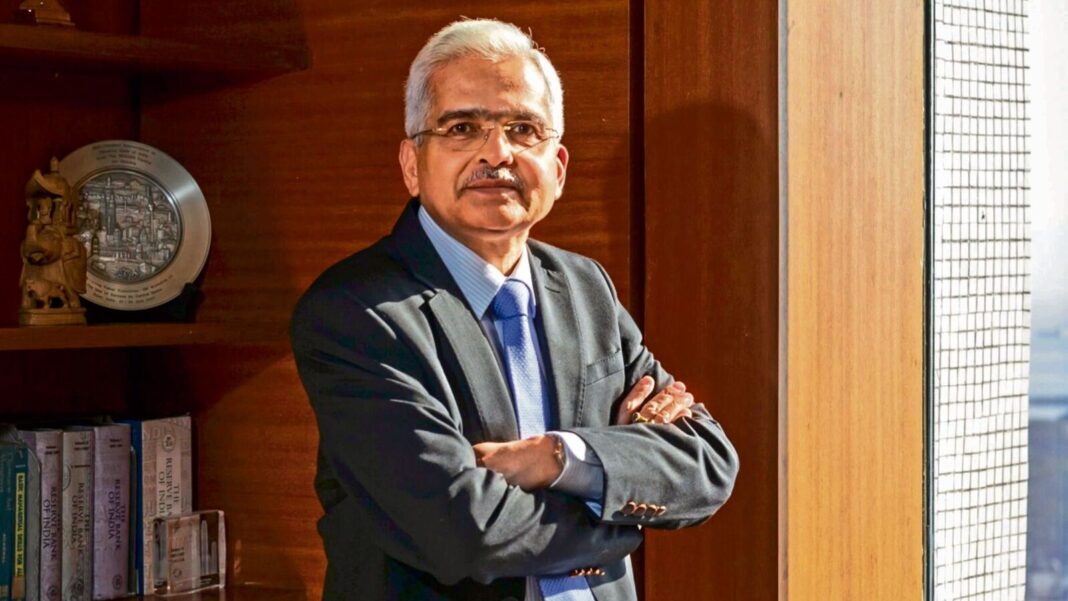

Under the leadership of Shaktikanta Das, the RBI has been cracking down on governance issues, ensuring that lenders adhere to strict regulations, even if it impacts the market sentiment.

NBFC Scrutiny

The RBI has been closely monitoring non-banking financial companies, aiming to regulate them as tightly as banks. The classification of NBFCs into four layers based on size and activity reflects the central bank’s evolving approach towards NBFC supervision.

Enforcement Evolution

Over the years, the RBI’s enforcement actions have evolved from moral suasion to stronger penalties. The establishment of an enforcement department within the RBI has led to more frequent regulatory actions and a focus on institution-wide compliance.

Industry Response

While some in the industry appreciate the RBI’s strict oversight as a means to identify and correct business flaws, others criticize the regulator for being overly harsh in its actions.

Call for an Appellate Tribunal

Amid increasing regulatory actions by the RBI, there is a growing demand within the industry for the establishment of an appellate tribunal to challenge enforcement orders. This would provide a platform for entities to contest RBI decisions effectively.