In Short:

HMD Global plans to transition around 300 million 2G users in India to affordable 4G ‘Cloud phones,’ partnering with CloudMosa for web-enabled features like YouTube and Facebook. Devices will range from ₹1,999 to ₹3,999. While HMD’s approach is similar to Jio’s, improving user experience is key. Analysts project 4G feature phones could hold a 30-35% market share amid shifting preferences.

HMD Global has announced its plans to facilitate the transition of nearly 300 million 2G users in India to enhanced 4G networks through the introduction of budget-friendly, Internet-enabled ‘Cloud phones.’ This initiative is spearheaded by senior executives within the company.

Partnership with CloudMosa

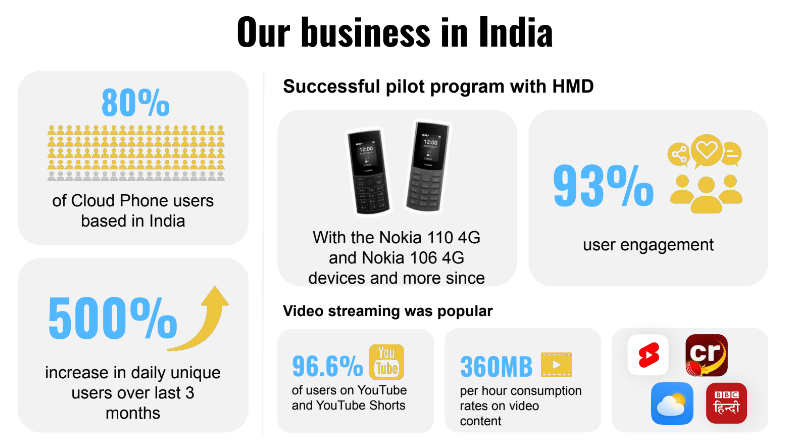

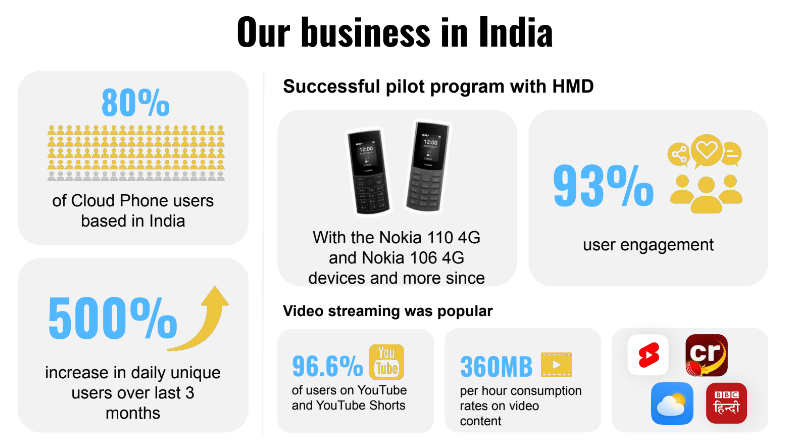

To realize this goal, HMD has partnered with CloudMosa, a technology firm based in the United States, to integrate a web browser-driven operating system into its feature phones. This system will support various multimedia applications, including YouTube, Facebook, Twitter, Wikipedia, and Radioline for streaming online radio channels.

Executives’ Insights

Ravi Kunwar, CEO and Vice President for India and APAC at HMD, expressed in an interview with ETTelecom, “The objective of the ecosystem here is how do we migrate these 300 million subscribers to a better user experience through cloud apps or multimedia apps? … The market data for the last one and a half years shows that our proposition to consumers is being accepted very well, which is resulting in growth of share for us.”

Competitive Landscape

The recent launch of the JioBharat 4G feature phone priced at ₹999 by Reliance Jio in July 2023 reflects similar ambitions of attracting more than 250 million 2G mobile broadband users, especially in rural markets. Kunwar noted that although HMD’s efforts may parallel those of Jio, the deciding factor for consumers will ultimately be the quality of user experience and support for applications on the 4G-enabled feature phone. He commented, “Any competition is better. It only makes the job much easier for consumers to choose from the better option.”

Range of Offerings

The Cloud phones offered by HMD are priced between ₹1,999 and ₹3,999, featuring UPI functionality, video calling, and access to applications like YouTube, Facebook, Google Assistant, and JioChat, although these devices are tied to the Jio network. In contrast, 4G Cloud phones will enable users to utilize applications and services hosted in the cloud, thus reducing the dependency on onboard storage or processing power.

CloudMosa’s Vision

Shioupyn Shen, Founder and CEO of CloudMosa, indicated the company’s willingness to collaborate with any telecom operator in India on a revenue-sharing model. “Our partnership with carriers is mostly revenue neutral. It is the device manufacturer that needs to pay us a nominal fee. We are not going to go through with carriers for any exclusive partnership,” he stated.

CloudMosa also collaborates with other device manufacturers such as Itel, Snexian, Blackzone, and MT in India. Shen emphasized that CloudMosa’s technology could potentially reduce the cost of a 4G feature phone by 50-80% compared to current market offerings, thus creating a significant opportunity to bridge the digital divide.

Global Landscape

India represents a critical market for CloudMosa, accounting for over 80% of its global user base, supported by investors such as Morningside, GIC, Inventec, Lenovo, and Foxconn.

Additionally, a recent launch by Vodacom South Africa in collaboration with Mobicel showcased a similar cloud-powered handset priced at merely $13.93 (~₹1,160).

Future Challenges and Opportunities

Analysts predict that the successful implementation of the Cloud phone initiative will largely depend on reliable 4G network coverage, particularly in underserved regions. Menka Kumari, an analyst at CyberMedia Research (CMR), remarked, “With many users still on 2G networks, there is a significant opportunity for 4G feature phones to enable this transition. However, as smartphone adoption increases, especially among younger demographics, sustaining interest in feature phones may become challenging.”

CMR anticipates that 4G feature phones will make up approximately 30-35% of the overall Indian feature phone market. Both Jio and HMD have contributed significantly to this growth by providing affordable connectivity options for users transitioning from 2G devices.

However, the growth rate of 4G feature phones is expected to slow in comparison to smartphones, with the 4G feature phone market projected to reach nearly 18 million units by 2025, sustaining a significant share, particularly in rural and semi-urban regions.